How to Calculate Monthly Home Loan in Malaysia

FIRST-TIME BUYER

Written by Fazrina Fezili

How to Calculate Monthly Home Loan in Malaysia (2025 Full Guide for Buyers)

Thinking About Buying a Home in Malaysia?

Buying a home is one of the biggest financial decisions in life and in Malaysia, property ownership is often seen as a long-term investment for security and stability. Before you sign the Sale and Purchase Agreement (SPA), the key question is:

“How much can I afford to pay every month for my home loan?”Your monthly instalment affects your lifestyle, savings and long-term goals. The good news: with the right formulas and a little planning, you can estimate your monthly repayment and set a realistic budget.

Step-by-Step Guide: How to Calculate Monthly House Loan Payment in Malaysia

Whether you are a first-time buyer, upgrading or investing, this guide walks you through everything: loan amount, interest types, tenure, quick formulas, detailed calculations and additional costs.

1. Know Your Total Loan Amount (Principal)

First, calculate how much the bank will finance. It’s simply the property price minus your down payment.

Formula: Loan Amount = House Price – Down PaymentExample: House price RM400,000 with 10% down payment (RM40,000) = RM360,000 loan.

Tip: Banks often finance up to 90% for first-time buyers. Prepare at least 10% down payment plus fees.

2. Understand Home Loan Interest Rates in Malaysia

Interest rate significantly affects your monthly instalment. In Malaysia, rates are quoted as an annual percentage. You’ll encounter two main types:

- Fixed Rate: Stable rate for a set period; monthly payments stay predictable.

- Floating Rate: Rate varies with the bank’s Base Rate (BR); monthly instalment can rise or fall.

SEO tip: Compare home loan interest rate Malaysia across banks, a 0.2% difference matters over 25-30 years.

3. Choose the Right Loan Tenure (Duration)

Tenure is how long you will repay the loan. Longer tenure lowers monthly payments but increases total interest paid.

| Loan Amount | Interest Rate | Tenure | Monthly Payment (Approx.) |

|---|---|---|---|

| RM360,000 | 4.5% | 30 years | RM1,824 |

| RM360,000 | 4.5% | 20 years | RM2,278 |

Tip: Balance affordability with total cost when choosing tenure.

4. Quick Estimation Formula

If you want a fast estimate before applying, use this simple rule-of-thumb:

House Price ÷ 200 = Estimated Monthly InstalmentExample: RM400,000 ÷ 200 = RM2,000/month (rough estimate)

5. Detailed Amortization Formula (Accurate)

For a precise monthly figure, use the amortization formula:

Monthly Payment = P × r × (1 + r)^n / [(1 + r)^n - 1]

Where:

P = principal (loan amount)

r = monthly interest rate (annual rate ÷ 12)

n = total months (years × 12)

Example: Loan RM360,000, annual rate 4.5%, tenure 30 years → approx RM1,824/month.

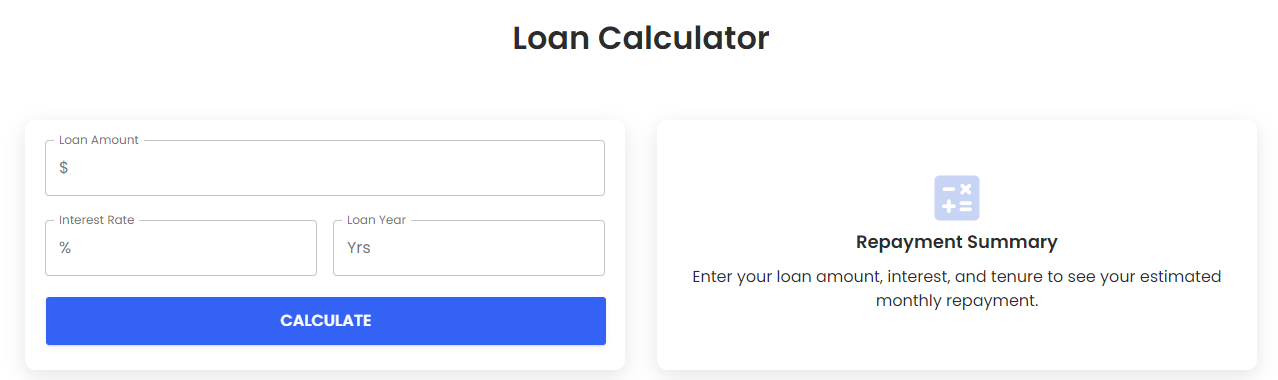

6. Use a Home Loan Calculator (Recommended)

If formulas look technical, use an online calculator such as Property Genie’s housing loan calculator. Enter loan amount, interest and tenure to get monthly instalment instantly.

SEO phrase: Use our free housing loan calculator Malaysia to compare scenarios fast.

7. Additional & Hidden Costs to Consider

Remember, owning a house involves other costs beyond your bank repayment:

- Legal fees for SPA and loan documentation

- Stamp duty on the property purchase

- Valuation fee required by banks

- Fire insurance (mandatory)

- MRTA / MLTA (mortgage-related life insurance)

- Quit rent & assessment tax to local councils

- Maintenance fees for condominiums or gated communities

Understand EIR (Effective Interest Rate)

EIR reflects the actual cost of borrowing after accounting for compound interest and additional loan charges. Always compare EIRs between banks to know which loan is truly cheaper.

SEO phrase: Compare EIR Malaysia to see the real cost of different home loans.

How Much Can You Borrow? Home Loan Eligibility

Banks assess eligibility using salary, existing debt commitments, credit score, and tenure. They often use the Debt Service Ratio (DSR) to gauge affordability.

Factors Banks Consider

- Monthly income: lenders typically cap repayments at 30–40% of income.

- Existing commitments like car loans and credit cards.

- Credit history (CCRIS / CTOS).

- Loan tenure: longer tenures improve affordability but increase total interest.

Debt Service Ratio (DSR) Formula

DSR = (Total Monthly Commitments ÷ Monthly Income) × 100Example: Car RM700 + Credit card RM200 + Home loan RM1,500 = RM2,400. If income RM6,000: DSR = (2,400 ÷ 6,000) × 100 = 40%

Most banks prefer a DSR below 50% for approval.

Are Insurance & Property Tax Included in Monthly Payments?

No. Monthly instalments generally cover principal + interest only. Insurance (fire, MRTA/MLTA) and property taxes are separate payments.

Common FAQs About Home Loans in Malaysia

What is MRTA vs MLTA?

MRTA (Mortgage Reducing Term Assurance) reduces coverage as the loan declines and is often cheaper. MLTA (Mortgage Level Term Assurance) provides fixed coverage throughout and can be taken independently. Choose based on cost and beneficiary needs.

How do banks calculate eligibility?

Using DSR, credit checks and reviewing your financial commitments. Keeping a clean repayment record helps a lot.

Can I refinance later to get a better rate?

Yes. Refinancing can lower your monthly instalment if market rates are lower. Check prepayment penalties before refinancing.

Practical Examples & Scenarios

Let’s look at two quick scenarios to illustrate how interest and tenure affect payments.

Scenario A: Lower Tenure, Higher Monthly Payment

Loan RM360,000, interest 4.5%, tenure 20 years → monthly ≈ RM2,278. You pay less total interest but higher monthly instalment.

Scenario B: Longer Tenure, Lower Monthly Payment

Loan RM360,000, interest 4.5%, tenure 30 years → monthly ≈ RM1,824. Easier monthly budget, more total interest over time.

Tip: Use the loan calculator to test different tenures and interest rates side-by-side.

Related Articles

Share :

Related Article

Article Highlights

home loan Malaysia

housing loan Malaysia

house loan calculator Malaysia

home loan interest rate Malaysia

property loan Malaysia

monthly house instalment Malaysia

how to calculate home loan Malaysia

mortgage repayment Malaysia

buy house Malaysia

home loan eligibility Malaysia

DSR Malaysia

MRTA Malaysia

MLTA Malaysia