NAPIC Q3 2025: Malaysia Property Market Report & Trends for Homebuyers and Investors

NEWS

Written by Fazrina Fezili

The Malaysian property market is at a critical juncture as we move into the second half of 2025. According to the National Property Information Centre (NAPIC), transaction volumes showed a slight decline in the first half of the year, while transaction values continued to tick upward. This suggests selective buying behaviour, stable pricing and shifting developer strategy.

The third quarter (Q3 2025) promises deeper insights into how homebuyers, investors and developers are adapting. In this article, we’ll unpack the key findings, highlight the major trends by property segment and geography, and draw actionable take-aways for both homebuyers and investors.

NAPIC Q3 2025: Deep Dive into the Malaysia Property Market 2025

The NAPIC Q3 2025 report gives one of the clearest pictures so far of the Malaysia property market 2025. It highlights where demand remains healthy, where the Malaysia property overhang continues to grow, and which regions and price ranges are performing better in the pasaran hartanah Malaysia.

This article covers the full breakdown of the Laporan NAPIC Q3 2025 including serviced apartment overhang, residential new launches, the house price index Malaysia (MHPI), office/shopping complex performance, construction activity, and what all of this means for buyers and investors heading into 2026.

1. Property Market Q3 2025 Snapshots (NAPIC Summary)

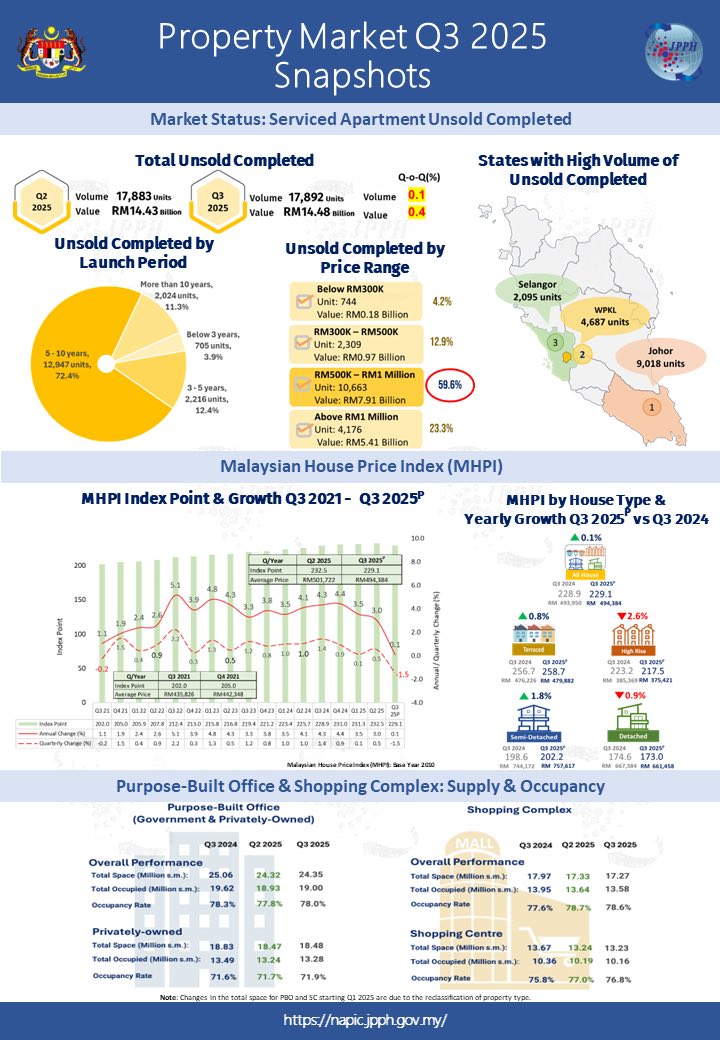

Below is the first major infographic from the NAPIC Q3 2025 report, covering transactions and construction activity nationwide.

From these snapshots, we can see several important national trends in the Malaysia property market 2025:

- 108,250 property transactions were recorded in Q3 2025, with a total value of RM64.39 billion.

- Residential remains the largest sub-sector by volume, followed by agriculture and commercial.

- Central and southern regions contribute a large share of transactions, reflecting strong activity in Selangor, Kuala Lumpur and Johor.

- Construction activity shows that completions, starts and new planned supply for residential and serviced apartments are still significant, but developers are clearly more cautious than they were a few years ago.

The rest of the Laporan NAPIC Q3 2025 breaks this big picture down by segment.2. Serviced Apartment Overhang: The Weakest Segment in Pasaran Hartanah Malaysia

Serviced apartments continue to record the highest Malaysia property overhang and are one of the most sensitive categories in the pasaran hartanah Malaysia.

1. Total Unsold Completed Serviced Apartments

According to the NAPIC Q3 2025 report:

- Q2 2025: 17,883 units, RM14.43 billion

- Q3 2025: 17,892 units, RM14.48 billion

Quarter-on-quarter, the volume is almost flat (+0.1%) and value edges up slightly (+0.4%). The problem is not that things suddenly got much worse in Q3; it’s that the Malaysia property overhang in serviced apartments was already very high.

2. Unsold by Price Range: Mid–Upper Segment Dominates

The overhang is dominated by the RM500k–RM1M segment:

- Below RM300,000 – small share of the total

- RM300,001 – RM500,000 – low to mid share

- RM500,001 – RM1 million – almost 60% of all unsold units

- Above RM1 million – around one quarter of the total by value

This shows that the pasaran hartanah Malaysia has been flooded with mid–upper priced serviced apartments that do not match the mass market’s real purchasing power.

3. States with the Highest Serviced Apartment Overhang

The same Laporan NAPIC Q3 2025 snapshot highlights three states with the highest unsold completed serviced apartments:

- Johor – 9,018 units

- WP Kuala Lumpur – 4,687 units

- Selangor – 2,095 units

These are exactly the locations many investors look at when they think of the Malaysia property market 2025, especially Johor Bahru and Kuala Lumpur city. For buyers and investors, the takeaway is simple:

High-rise and serviced apartments in these states should be approached carefully, with extra focus on price, location, rental demand and actual occupancy.

3. Malaysia House Price Index (MHPI): Stability with Mild Shifts

The same first infographic also includes the Malaysian House Price Index (MHPI), giving an official view of harga rumah Malaysia 2025.

From the NAPIC Q3 2025 report:

- Terrace houses record a very small +0.1% yearly growth.

- High-rise units show slightly stronger positive growth.

- Semi-detached and detached houses record negative yearly growth, indicating some softening at the upper end of the landed market.

In simple terms, the house price index Malaysia suggests that:

- Prices are not crashing, which is important for homeowner confidence.

- But the days of very rapid price growth are also behind us in most areas.

- The strongest price stability is in the mass-market and mid-market terrace and high-rise segment, not in the high-end landed segment.

This is very relevant for both owner-occupiers and investors trying to decide when to enter the Malaysia property market 2025 and which type of product to focus on.

4. Office & Shopping Complex: Supply and Occupancy

At the bottom of the first infographic, NAPIC provides an overview of purpose-built office and shopping complex performance.

For purpose-built office (government and privately owned) in Q3 2025:

- Total space has increased compared to Q3 2024, partly due to reclassification of property types.

- Occupied space also remains relatively strong, but the occupancy rate varies between government and private buildings.

For shopping complexes (shopping centres):

- Total space continues to grow slightly.

- Occupancy rate is around the 80% range, which is decent but not spectacular.

This supports the general view that the pasaran hartanah Malaysia for retail and office is stable but facing structural change. Well-located, modern malls and integrated office developments still do reasonably well, but older or poorly located buildings will struggle to compete.

5. Residential New Launches & Unsold Status

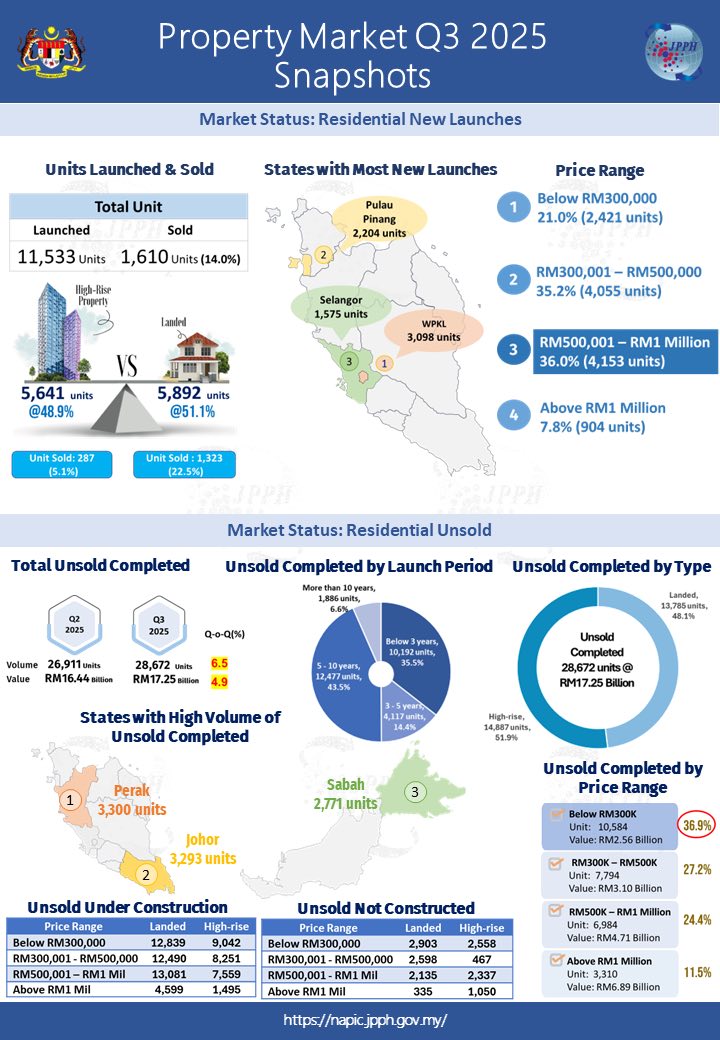

Next is the second major infographic focusing on new launches and residential overhang.

1. Units Launched vs Units Sold

According to the NAPIC Q3 2025 report:

- 11,533 units were launched in Q3 2025.

- Only 1,610 units were sold in the same period.

- This is a take-up rate of 14%, which is quite low.

Breaking it down by product type:

- High-rise: 5,641 units launched, 287 units sold (about 5.1% take-up).

- Landed: 5,892 units launched, 1,323 units sold (about 22.5% take-up).

- This aligns with what agents on the ground in the Malaysia property market 2025 have been seeing:

Landed homes still attract strong interest, while brand new high-rise units—especially in oversupplied areas—are much harder to move.

2. States with the Most New Launches

The Laporan NAPIC Q3 2025 map shows:

- Pulau Pinang (Penang) – 2,204 units

- Selangor – 1,575 units

- WPKL – 3,098 units

These are key battlegrounds in the pasaran hartanah Malaysia, where competition between developers is intense and buyers have many choices.

3. New Launches by Price Range

The same infographic breaks new launches down by price:

- Below RM300,000 – 21.0% (2,421 units)

- RM300,001 – RM500,000 – 35.2% (4,055 units)

- RM500,001 – RM1 million – 36.0% (4,153 units)

- Above RM1 million – 7.8% (904 units)

The fact that over 70% of new launches sit between RM300k and RM1 million confirms that developers are targeting the mid-market—the core of the Malaysia property market 2025 where most real demand is.

6. Residential Unsold (Overhang) – Rumah Tidak Terjual Malaysia

The bottom half of the second infographic is all about unsold completed residential units, a key part of the Malaysia property overhang story.

1. Total Residential Unsold Completed

From the NAPIC Q3 2025 report:

- Q2 2025: 26,911 units, RM16.44 billion

- Q3 2025: 28,672 units, RM17.25 billion

Quarter-on-quarter:

- Units increased by 6.5%

- Value increased by 4.9%

So the residential rumah tidak terjual Malaysia problem is getting worse, not better, even as developers scale back new high-risk launches.

2. Unsold by Launch Period

The launch period pie chart shows that:

- A big portion of unsold units were launched 5–10 years ago.

- Another sizeable portion is below 3 years, i.e. fairly recent projects.

- A smaller share is more than 10 years old.

This tells us that the Malaysia property market 2025 is still digesting the legacy of aggressive launches from previous cycles, especially between 2013 and 2018.

3. Unsold by Type & Price Range

From the infographic:

- Unsold units are almost evenly split between landed (48.1%) and high-rise (51.9%).

- By price, the highest share of unsold units is below RM300,000 (36.9%), followed by RM300k–RM500k (27.2%), RM500k–RM1m (24.4%) and above RM1m (11.5%).

- This may surprise some readers. It means the Malaysia property overhang is not just about expensive homes; even “affordable” homes can sit unsold if they are in the wrong place, poorly connected or lacking real demand drivers.

4. States with High Residential Overhang

NAPIC flags three states with the highest volumes of unsold completed residential units:

- Perak – 3,300 units

- Johor – 3,293 units

- Sabah – 2,771 units

These states are important areas to watch for buyers and investors in the Malaysia property market 2025, especially if you’re considering new projects there.

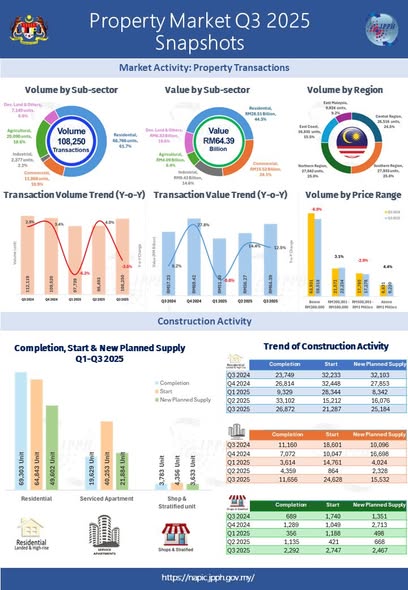

7. Property Transactions & Construction Activity

The following infographic covers the national transaction breakdown and construction trends:

1. Transactions by Sub-Sector and Region

The NAPIC Q3 2025 report confirms that:

- Residential transactions still account for the majority of deals in the pasaran hartanah Malaysia.

- Agricultural, commercial and industrial sectors each take up a smaller but meaningful share.

- The Central region (Selangor and Kuala Lumpur), the Southern region (Johor, Melaka, Negeri Sembilan) and the Northern region (Penang, Kedah, Perlis, Perak) show varying levels of activity, with the central region typically leading in both value and volume.

2. Volume & Value Trends

The charts show transaction volume and value trends year-on-year. While quarterly performance may fluctuate, the key takeaway for the Malaysia property market 2025 is:

- Volumes have not returned to pre-2015 peaks, but

- Values remain supported by steady prices and selective higher-value transactions.

3. Construction Activity – Completions, Starts & New Planned Supply

The lower section tracks completion, start and new planned supply from Q1 to Q3 2025, for:

- Residential

- Serviced apartments

- Shops and stratified commercial

- Others

A clear pattern appears:

- Completions remain high because they reflect past decisions made during earlier cycles.

- Starts and new planned supply are more moderate, showing developer caution in the current Malaysia property market 2025 environment.

This is healthy for the long term, if supply keeps moderating while demand gradually absorbs existing Malaysia property overhang, market balance should slowly improve.

What This Means for Buyers in the Malaysia Property Market 2025

For homebuyers, the Laporan NAPIC Q3 2025 offers several practical lessons:

1. You have more choice than ever, especially in high-rise and serviced apartments.

Overhang numbers show that there is plenty of unsold stock; buyers can afford to be choosy.

2. Landed homes in established townships remain strong.

Take-up rates for landed new launches are much better than for high-rise projects. If your budget allows, landed homes remain a safer bet in many parts of the pasaran hartanah Malaysia.

3. Not all “affordable” homes are good buys.

Even units below RM300,000 make up a big part of the rumah tidak terjual Malaysia stats. Cheap does not automatically mean good location, connectivity and overall demand still matter.

4. Look at state-level patterns.

In states like Perak, Johor and Sabah, there is already plenty of unsold stock. Buying into another similar project in the same area may mean facing tougher resale or renting conditions later.

What This Means for Investors in the Malaysia Property Market 2025

For investors, the NAPIC Q3 2025 report is a gold mine of information:

- Avoid blindly chasing serviced apartments in Johor Bahru, Kuala Lumpur and oversupplied corridors. The overhang numbers tell you supply is already more than enough.

- Focus on rental fundamentals and long-term demand drivers. Look at areas with strong job hubs, universities, industrial parks, ports or transport interchanges, these locations will perform better in the long run, even if the national Malaysia property overhang remains high.

- Consider older, well-located properties instead of brand new launches. In some mature neighbourhoods, you can buy subsale units at lower prices than brand new units nearby, yet still enjoy solid demand.

- Industrial and logistics properties may offer better risk-adjusted returns than residential high-rise in the current cycle, especially in states like Johor and Penang.

The three official Property Market Q3 2025 Snapshots from NAPIC give everyone from policymakers to first-time buyers a clear view of where the Malaysia property market 2025 stands:

- Serviced apartments face the biggest overhang problem.

- Residential new launches are skewed to the mid-market, but sales remain modest.

- The house price index Malaysia is stable, without dramatic swings.

- Office and shopping complexes are adapting rather than collapsing.

- Transaction and construction trends show a cautious, adjusting market.

If you use the Laporan NAPIC Q3 2025 as your reference and combine it with on-the-ground research, you’ll be in a much stronger position to make smart buying or investment decisions in the years ahead.

Share :

Related Article

Article Highlights

napic q3 2025

laporan napic q3 2025

malaysia property market 2025

pasaran hartanah malaysia

malaysia property overhang

rumah tidak terjual malaysia

residential overhang malaysia

house price index malaysia

mhpi malaysia

malaysia real estate report

serviced apartment overhang malaysia

unsold property malaysia

property market report malaysia

johor property market 2025

kuala lumpur condo market 2025

selangor property market 2025

penang property market 2025

perak property market 2025

sabah property market 2025

new property launches malaysia 2025

malaysia real estate trends 2025

malaysia housing market 2025

malaysia property analysis

property market outlook malaysia 2026

affordable homes malaysia 2025

high rise property malaysia

landed property malaysia