NAPIC Q3 2025: Are Malaysian House Prices Rising or Stabilising?

NEWS

Written by Fazrina Fezili

NAPIC Q3 2025: Are Malaysian House Prices Rising or Stabilising?

The latest data from the National Property Information Centre (NAPIC) for Q3 2025 delivers a clear (if somewhat muted) message about the Malaysian property market: house prices in Malaysia are more in a phase of stabilisation than rapid growth.

For those wondering “are house prices in Malaysia rising?”, the answer is: only slightly. For those asking “is the Malaysia property market 2025 still strong or cooling?” it’s somewhere in between.

This article breaks down the key numbers from the NAPIC Q3 2025 report, explores what the Malaysia house price trend looks like, examines which segments are stronger or weaker, and offers an outlook for the Malaysia property market 2026.

Headlines from NAPIC Q3 2025

Here are the major take-aways from NAPIC’s Q3 2025 report on the Malaysia property market 2025:

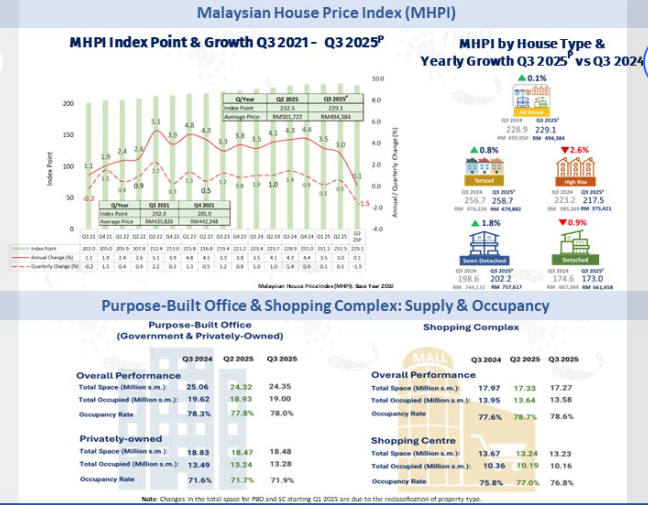

- The national Malaysian House Price Index (MHPI) was roughly 229.1 points in Q3 2025.

- Year-on-year growth in the MHPI stood at about +0.1%, indicating nearly flat price movement.

- The average house price in Malaysia in Q3 2025 was approximately RM 494,384 per unit.

- Transaction volume across all property types (residential + non-residential) fell slightly; however transaction value rose, suggesting fewer deals but more value per deal.

- The overhang (unsold completed stock) continued to rise in some segments, especially high-rise and serviced apartments.

- Government policy (financing, incentives) and macro-economic conditions (interest rates, inflation) are influencing the market balance of affordability vs supply.

In short: Malaysian house prices 2025 are essentially stable not booming, not collapsing.

How Did We Get Here? Recap of 2024 and the First Half of 2025

2024: Transaction Boom, Moderate Price Growth

In 2024, the Malaysia property market experienced a rebound of sorts from the pandemic years. Transaction volumes and values surged, and the MHPI showed modest growth.

According to NAPIC’s 2024 Property Market Report, Malaysia’s property market recorded its strongest performance in a decade:

- Transaction numbers climbed strongly.

- NAPIC’s 2024 findings (industry summarised) show the average home price was around RM486,678, with moderate growth.

- This meant the Malaysia house price trend was positive but cautious — signalling recovery, not acceleration.

In other words, 2024 was a busy year: a lot of homes changed hands, but price growth stayed moderate.

H1 2025: Slowing Momentum, Shift to Quality

By the first half of 2025, the market started to show signs of normalisation. Based on NAPIC’s H1 2025 Property Market Report and Ministry of Finance summaries:

- Transaction volume fell (-1.3%), but

- Transaction value increased (+1.9%), reflecting a shift towards higher-value purchases.

This shift suggests:

- Buyers were more selective, focusing on better-located or better-designed projects.

- Developers were more cautious, particularly with mass-market high-rise launches.

- Signs of mismatch became clearer too many condos, not enough affordable/landed homes.

By Q3 2025, the Malaysia house price trend had cooled into a stabilisation phase, preparing the market for a more balanced 2026.

What the Q3 2025 Data Tells Us on House Prices and Trends

For Q3 2025, NAPIC released Property Market Q3 2025 Snapshots and a Press Release Property Market Report 2025 (Q3 2025), together with a video briefing by JPPH. These confirm a few key themes:

1. House Prices: Slightly Up, But Mostly Flat

With the average house price at roughly RM 494k, there is a nominal increase compared to previous years. However, when you compare to inflation, cost of living, and interest rates, the value growth is minimal.

The MHPI’s +0.1% growth signals near-flat real movement.

For those asking “are Malaysian house prices rising?”, the short answer is “yes, but only slightly”. The longer answer: growth is so marginal that for many buyers and investors, prices are effectively stabilising.

When you compare Q3 2025 to the same period a year earlier, price increases are:

- Positive but small, no big spike.

- Slower than previous years, especially after the strong post-pandemic rebound.

After adjusting for inflation (around 1–2% in 2025), the real (inflation-adjusted) price movement is close to zero.

2. Transactions: Fewer Deals, But Higher Value

NAPIC’s Q3 2025 snapshot shows a common pattern:

- Transaction volume dips slightly compared to the previous year.

- Total value of transactions rises, driven by mid- to higher-value properties.

This usually means:

- Fewer units are being transacted, but each transaction is, on average, bigger in RM terms.

- Buyers are more selective, yet still willing to commit for the right product and location.

3. New Launches & Overhang: Type & Location Matter

Across the residential segment, NAPIC highlights three important points:

- New launches are cautious. Developers are no longer flooding the market with large volumes of new units.

- Overhang remains high, especially for high-rise apartments and serviced residences.

- Unsold completed units continue to number in the tens of thousands, with a significant chunk in certain parts of Klang Valley, Penang and Johor.

Overhang is one of the main reasons why price growth is capped in some segments, even though overall demand hasn’t disappeared.

4. Financing Environment: OPR Cut Offers Some Relief

During 2025, Bank Negara Malaysia reduced the Overnight Policy Rate (OPR) from 3.00% to around 2.75%. This:

- Helps lower monthly instalments slightly for new borrowers.

- Supports housing affordability, especially for first-time buyers.

Combined with housing-related measures in Budget 2025 and Budget 2026 (e.g. schemes like Rumah Mesra Rakyat, PR1MA, Residensi MADANI, and SJKP guarantees), the downside risk for residential demand is cushioned, even as the market cools.

5. Strong performance in selected states

Industry analysis referencing NAPIC data (Business Times Singapore + MyRumahBaru):

- Johor: Strong momentum due to the Johor–Singapore SEZ, industrial growth, and Singapore spill-over

- Penang: Boosted by manufacturing, talent inflow, and strong rental demand

- Perlis: Healthy growth in smaller markets from local upgrader demand

- Selangor & Negeri Sembilan: Good performance in connected townships (e.g., Semenyih, Nilai, Seremban 2)

Meanwhile:

- Kuala Lumpur high-rise continues to be weighed down by oversupply

What Q3 2025 Means for Different Types of Buyers?

First-Time Homebuyers

For first-time buyers, the Q3 2025 environment is actually quite favourable:

- Prices are not racing away from you, overall growth is mild.

- OPR at around 2.75% keeps financing costs relatively manageable compared to previous years.

- Various government schemes support downpayments, guarantees and interest relief for eligible buyers, especially in the affordable range.

Practical tips for first-time buyers:

- Focus on properties in the RM300k to RM500k band where incentives and genuine demand are strongest.

- Consider subsale landed houses in mature neighbourhoods; NAPIC data shows subsale transactions dominate the market.

- Use overhang to your advantage, but be careful: cheap isn’t always good if the area has weak rental demand and poor maintenance.

Upgraders and Own-Stay Buyers

If you are upgrading from a condo to a landed home, or moving to a larger property:

- Your existing high-rise unit may not have gained much in value, especially if it is in an oversupplied location.

- Landed homes in good locations have generally held their value better.

Strategy-wise, it may make sense to price your existing property realistically for a quicker sale, then buy into emerging townships or maturing suburban areas where infrastructure is improving but prices are still reasonable.

Investors

For investors, NAPIC’s Q3 2025 data reinforces one key message:

- Capital appreciation is no longer the only story.

- Today’s property game is more about rental yield and specific growth corridors than blanket price rises.

Where the data and research are pointing:

- Industrial & logistics remain the strongest performing sector, especially in Johor, Penang and Selangor.

- Growth corridors linked to SEZs, RTS, ECRL and data centre investments may outperform the national average.

- Generic condos without strong rental demand or unique selling points should be approached with caution, unless the price is well below market and backed by real demand.

5 Key Malaysia House Price Trend Q3 2025

- House prices are stabilising, not booming. The MHPI shows only mild year-on-year growth, with average national prices hovering around the high RM400k range.

- Transactions dip slightly, but value rises. Fewer deals but higher total value means buyers are more selective yet still active.

- Overhang is still a drag. Unsold completed units especially condos and serviced apartments remain a major issue.

- Landed and affordable homes are more resilient. Terrace houses and affordable price bands see steadier demand and firmer prices.

- Johor, Perlis and industrial-linked regions stand out. These locations are more likely to show above-average growth due to strong economic and infrastructure drivers.

Outlook of Malaysia Property Market 2026 and Beyond

Looking ahead, most research houses and the policy direction under Malaysia MADANI, Budget 2025 and Budget 2026 point towards a steady but selective property market:

- The government continues to push for affordable housing and aims to deliver large numbers of homes over the medium term.

- Large infrastructure projects (RTS, ECRL, Pan Borneo, SEZs, data centres) will shift demand to specific corridors, rather than lifting all locations equally.

- The national MHPI is likely to show modest positive growth, not a bubble or a cliff.

For buyers and investors, this is a market where strategy matters more than timing. Choosing the right location, property type and price point is more important than trying to “time” a big crash or spike that may not come.

FAQ: Malaysia House Prices Q3 2025

Q1: Are house prices in Malaysia rising in 2025?

Broadly speaking no, not significantly across the board. The market is stabilising rather than rising sharply. While transaction values are up in certain segments, volumes are down and average price growth is modest.

Q2: Which segments show better price growth in the Malaysia property market 2025?

Landed homes in growth states, affordable homes below ~RM300k-RM500k, and properties in growth corridors (Johor, Penang) show relatively stronger potential. Oversupplied high-rise towers in urban centres less so.

Q3: Is now a good time to buy property in Malaysia?

For own-stay buyers wanting a home, yes, especially if selecting the right location, type and price band. For investors, yes but with realistic expectations: yield matters more than rapid price appreciation.

Q4: What is the Malaysia House Price Index (MHPI)?

The MHPI is the index compiled by NAPIC (via JPPH) tracking changes in residential property prices. It is a key benchmark for analysing Malaysia house prices 2025 and beyond.

The headline for the Malaysia property market 2025: stable but selective. While the era of rapid house-price inflation looks to be behind us (at least for the mass-market), the fundamentals still support decent opportunities if you choose wisely.

- National average house-price growth is modest; this means less “fear of missing out” but also less chance of quick gains.

- Location + property type + price band matter more than ever.

- Affordability and financing will be important pillars, buyers need to ensure monthly commitments remain comfortable.

- The Malaysia property market outlook for 2026 continues to support demand, but it will be a story of steady growth rather than boom.

Other Article:

Share :

Related Article

Article Highlights

napic q3 2025

malaysia house price index 2025

mhpi malaysia 2025

malaysia house price trend

malaysian house prices 2025

malaysia property market 2025

are house prices in malaysia rising

malaysia house price report

napic malaysia property report

malaysia property analysis 2025

malaysia property outlook 2026

malaysia house price forecast

napic data malaysia

malaysia residential market 2025

malaysia housing affordability 2025

malaysia house price stabilising

malaysia property market stabilising

malaysia property price trend

malaysia real estate market 2025

malaysia house price statistics

malaysia property demand 2025

malaysia high rise oversupply

malaysia condo oversupply 2025

malaysia landed property demand

johor property market 2025

penang property market 2025

perlis property market 2025

kl condo market 2025

kuala lumpur high rise oversupply

affordable housing malaysia 2025

rumah mampu milik 2025

rumah bawah 500k malaysia

malaysia rental yield 2025

gross rental yield malaysia

malaysia property investment 2025

best property investment malaysia

malaysia first time homebuyer 2025

malaysia property market stabilisation

malaysia real estate forecast 2026

malaysia property supply and demand

malaysia property overhang 2025

napic overhang data malaysia

malaysia serviced apartment oversupply

rumah subsale malaysia

landed property malaysia 2025

malaysia property trends and insights

malaysia property research 2025